How Business Owner's Can Leverage Balance Sheets!

This comprehensive guide discusses exactly how business owners can leverage Balance Sheets in their business

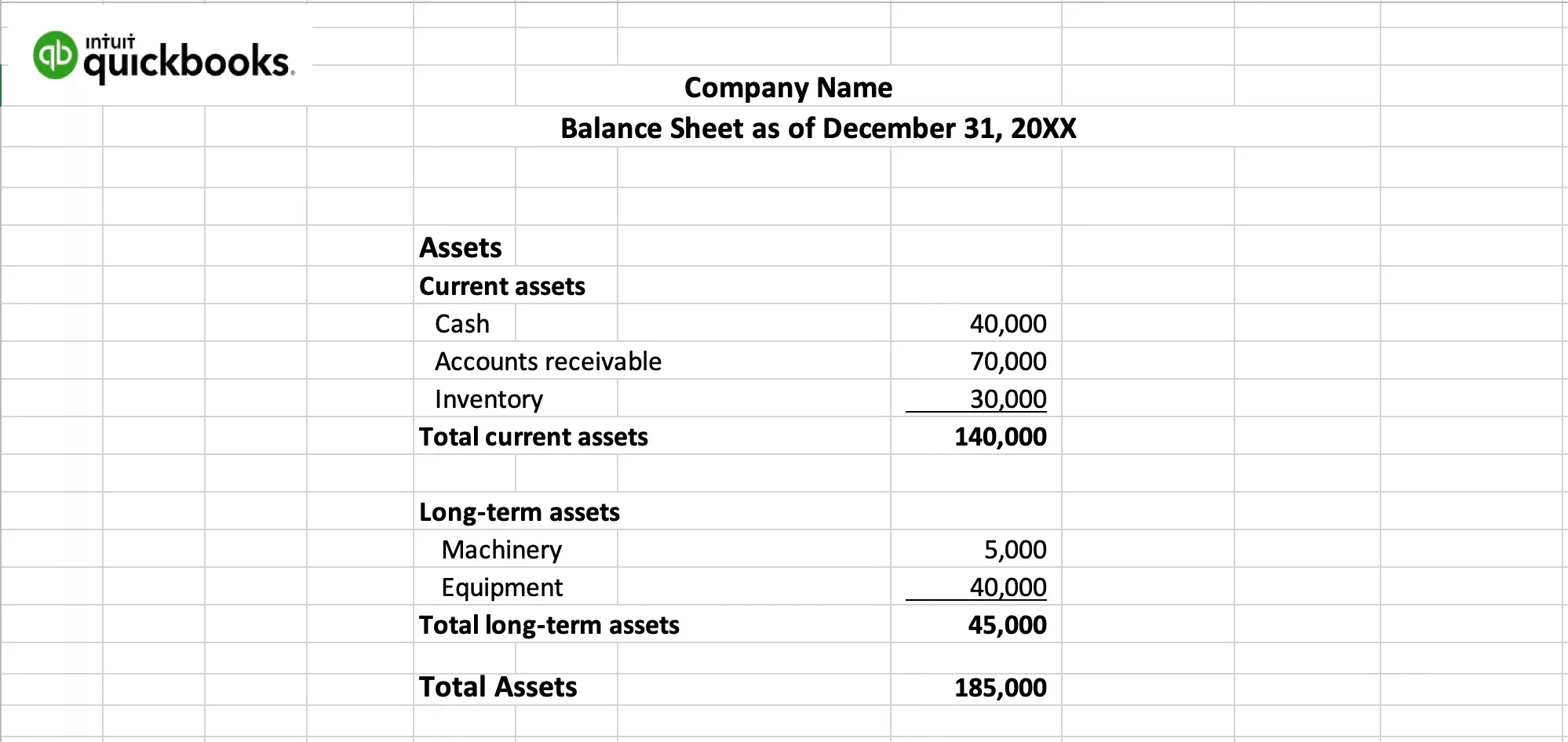

Simple Example Balance Sheet from QuickBooks Online

Introduction to Balance Sheets

A balance sheet is a financial statement that presents a company's financial position at a specific point in time. It provides an overview of the company's assets, liabilities, and equity and is used to assess the company's financial health and stability. In this article, we will cover the basics of balance sheets, including what they are, what information they include, how to prepare and interpret them, and how to use them to make informed financial decisions for your business.

What is a balance sheet and how is it used?

Balance sheets are a snapshot of a company's financial position at a specific point in time. It is typically prepared at the end of an accounting period, such as a month, quarter, or year, and provides a summary of the company's assets, liabilities, and equity as of that date. The balance sheet is used to assess the financial health of a company and to understand its financial position and potential for growth.

Balance sheets are based on the accounting equation, which states that a company's assets must equal the sum of its liabilities and equity. This means that the balance sheet is always in balance, with the value of the company's assets being equal to the value of its liabilities and equity.

The balance sheet is divided into two main sections: the assets section and the liabilities and equity section. The assets section lists the company's resources that are expected to provide future economic benefits, such as cash, investments, inventory, and property. The liabilities and equity section lists the company's obligations and the residual interest in the company's assets.

What information is included on a balance sheet?

The balance sheet includes information about a company's assets, liabilities, and equity.

Assets: The assets section of the balance sheet lists the company's resources that are expected to provide future economic benefits. Assets are typically divided into two categories: current assets and non-current assets.

Current assets are assets that are expected to be converted into cash or used up within one year or less. Examples of current assets include cash, accounts receivable, and inventory.

Non-current assets are assets that are expected to provide economic benefits beyond one year. Examples of non-current assets include property, plant, and equipment, and intangible assets such as patents and trademarks.

Liabilities: The liabilities section of the balance sheet lists the company's obligations that are due within one year or less. Liabilities are typically divided into two categories: current liabilities and non-current liabilities.

Current liabilities are obligations that are expected to be settled within one year or less. Examples of current liabilities include accounts payable, taxes owed, and short-term loans.

Non-current liabilities are obligations that are not due within one year. Examples of non-current liabilities include long-term debt and pension obligations.

Equity: The equity section of the balance sheet represents the residual interest in the company's assets. It represents the amount of the company's assets that is owned by the shareholders. Equity is typically divided into two categories: common stock and retained earnings.

Common stock represents the amount of capital that has been contributed by the company's shareholders. Retained earnings represent the profits that the company has earned and retained over time.

How do I prepare a balance sheet for my business?

To prepare a balance sheet for your business, you will need to gather financial information about your company's assets, liabilities, and equity. This information can be obtained from your company's financial records, such as ledgers, bank statements, and tax documents.

To prepare the balance sheet, you will need to follow these steps:

- Gather your financial records: Collect all of the financial documents and records that you will need to prepare the balance sheet. This may include ledgers, bank statements, and tax documents.

- Determine the date of the balance sheet: The balance sheet is a snapshot of your company's financial position at a specific point in time, so you will need to determine the date of the balance sheet. This is typically the end of an accounting period, such as the end of a month, quarter, or year.

- List your assets: The first section of the balance sheet is the assets section. Start by listing your company's assets, including both current and non-current assets. Assets should be listed in order of liquidity, with the most liquid assets (such as cash) listed first and the least liquid assets (such as property) listed last.

- List your liabilities: The second section of the balance sheet is the liabilities section. List all of your company's liabilities, including both current and non-current liabilities. Liabilities should be listed in order of maturity, with the shortest-term liabilities (such as accounts payable) listed first and the longest-term liabilities (such as long-term debt) listed last.

- Calculate equity: The equity section of the balance sheet represents the residual interest in your company's assets. To calculate equity, subtract your liabilities from your assets. The result is your equity.

- Review and adjust: Review your balance sheet to ensure that it is accurate and complete. Make any necessary adjustments to correct any errors or omissions.

How do I read and interpret a balance sheet?

To read and interpret a balance sheet, you will need to understand the different components of the balance sheet and how they relate to each other. Here are some tips for reading and interpreting a balance sheet:

- Understand the purpose of the balance sheet: The balance sheet is a snapshot of a company's financial position at a specific point in time. It provides information about the company's assets, liabilities, and equity and is used to assess the company's financial health and stability.

- Know the structure of the balance sheet: The balance sheet is divided into two main sections: the assets section and the liabilities and equity section. The assets section lists the company's resources that are expected to provide future economic benefits, such as cash, investments, inventory, and property. The liabilities and equity section lists the company's obligations and the residual interest in the company's assets.

- Look at the relationship between assets, liabilities, and equity: The balance sheet is based on the accounting equation, which states that a company's assets must equal the sum of its liabilities and equity. This means that the balance sheet is always in balance, with the value of the company's assets being equal to the value of its liabilities and equity.

- Analyze the trends: Look for trends in the balance sheet over time. Are the company's assets, liabilities, and equity increasing or decreasing? What factors may be driving these changes?

- Compare the balance sheet to industry benchmarks or competitors: It can be helpful to compare the balance sheet of your company to industry benchmarks or to the balance sheets of similar companies in the same industry. This can help you understand how your company's financial position compares to others in the industry and identify areas of strength or weakness.

How do I use a balance sheet to assess the financial health of my business?

There are several financial ratios and metrics that you can use to assess the financial health of your business using a balance sheet . Here are a few examples:

- Current ratio: The current ratio is a measure of a company's ability to pay its short-term debts. It is calculated by dividing current assets by current liabilities. A current ratio of 1 or higher is generally considered healthy, indicating that the company has sufficient assets to cover its short-term debts.

- Debt-to-equity ratio: The debt-to-equity ratio is a measure of a company's financial leverage. It is calculated by dividing total liabilities by total equity. A high debt-to-equity ratio may indicate that the company is heavily reliant on borrowed funds, which can be risky. A lower debt-to-equity ratio may indicate that the company has a stronger financial position.

- Return on equity: Return on equity (ROE) is a measure of a company's profitability and efficiency. It is calculated by dividing net income by shareholder equity. A high ROE may indicate that the company is generating strong profits and is effectively using its assets to generate income.

- Cash flow: Cash flow is a measure of the amount of cash that is generated by a company's operations. It is important to have a positive cash flow in order to meet short-term obligations and invest in long-term growth. You can use the cash flow statement, which is one of the financial statements that is typically included in a company's annual report, to understand the company's cash flow.

How do I compare my balance sheet to industry benchmarks or competitors?

To compare your balance sheet to industry benchmarks or competitors, you will need to gather financial information about your industry and about similar companies in the same industry. This information can be obtained from a variety of sources, such as industry reports, company financial statements, and online databases.

Once you have gathered this information, you can use financial ratios and metrics, such as the ones mentioned above, to compare your company's financial position to industry benchmarks or to the financial positions of similar companies. This can help you understand how your company's financial position compares to others in the industry and identify areas of strength or weakness.

It is important to keep in mind that industry benchmarks and comparisons to competitors should be used as a general guide and should not be taken as definitive measures of a company's financial health. Every company is unique, and it is important to consider a variety of factors when assessing the financial health of your business.

How do changes in assets, liabilities, and equity affect my balance sheet?

Changes in assets, liabilities, and equity can have a significant impact on a company's financial position and can affect the balance sheet. Here are a few examples of how changes in these components can affect the balance sheet:

- Changes in assets: Increases in assets, such as the acquisition of new property or the purchase of inventory, can improve a company's financial position by providing additional resources that can be used to generate income. Decreases in assets, such as the sale of property or the depletion of inventory, can decrease a company's financial position by reducing its resources.

- Changes in liabilities: Increases in liabilities, such as the acquisition of new debt or the issuance of new bonds, can decrease a company's financial position by increasing its obligations. Decreases in liabilities, such as the repayment of debt or the expiration of bonds, can improve a company's financial position by reducing its obligations.

- Changes in equity: Changes in equity can affect a company's financial position in a number of ways. Increases in equity, such as the issuance of new shares of stock or the retention of profits, can improve a company's financial position by providing additional resources for growth. Decreases in equity, such as the issuance of dividends or the sale of assets, can decrease a company's financial position by reducing its resources.

How do I use a balance sheet to make financial decisions for my business?

A balance sheet can be a valuable tool for making informed financial decisions for your business. Here are a few examples of how you can use a balance sheet to make financial decisions:

- Assessing financial health: A balance sheet can help you assess the financial health of your business and identify areas of strength or weakness. By analyzing the balance sheet, you can get a sense of the company's financial position and potential for growth.

- Evaluating investment opportunities: A balance sheet can help you evaluate potential investment opportunities by providing information about a company's financial position and risk profile. By analyzing the balance sheet, you can get a sense of the company's assets, liabilities, and equity and understand how it is using its resources to generate income.

- Making financial projections: A balance sheet can be a useful tool for making financial projections and creating a budget or financial plan for your business. By analyzing the balance sheet and understanding the trends in your company's assets, liabilities, and equity, you can make informed estimates about the future performance of your business and plan for future growth.

- Assessing risk: A balance sheet can help you assess the level of risk associated with your business. By analyzing the balance sheet, you can get a sense of the company's debt-to-equity ratio, cash flow, and other financial metrics that can indicate the level of risk associated with your business.

- Communicating financial information to stakeholders: A balance sheet can be a useful tool for communicating financial information to stakeholders, such as shareholders, investors, and lenders. By providing a clear and concise overview of your company's financial position, you can help stakeholders understand the financial health of your business and make informed decisions about your company.

How do I use a balance sheet to create a budget or financial plan?

A balance sheet can be a valuable tool for creating a budget or financial plan for your business. By analyzing the balance sheet and understanding the trends in your company's assets, liabilities, and equity, you can make informed estimates about the future performance of your business and plan for future growth.

To use a balance sheet to create a budget or financial plan, follow these steps:

- Review the balance sheet: Start by reviewing the balance sheet and understanding the trends in your company's assets, liabilities, and equity. Look for any changes or patterns that may be relevant to your budget or financial plan.

- Identify your financial goals: Determine your financial goals for the upcoming period, such as increasing revenue, reducing expenses, or improving cash flow.

- Estimate future performance: Based on the trends in your balance sheet and your financial goals, make estimates about your company's future performance. This may include estimating future revenue, expenses, and cash flow.

- Create a budget or financial plan: Using your estimates of future performance, create a budget or financial plan that outlines the steps you will take to achieve your financial goals. This may include setting targets for revenue, expenses, and cash flow, as well as identifying any investments or other actions that you will need to take to achieve your goals.

- Monitor and adjust: Regularly review your budget or financial plan and make any necessary adjustments based on actual performance and changes in your business.

How do I use a balance sheet to communicate financial information to stakeholders?

A balance sheet is an important tool for communicating financial information to stakeholders, such as shareholders, investors, and lenders. By providing a clear and concise overview of your company's financial position, you can help stakeholders understand the financial health of your business and make informed decisions about your company.

To use a balance sheet to communicate financial information to stakeholders, follow these steps:

- Review the balance sheet: Start by reviewing the balance sheet and ensuring that it is accurate and complete.

- Determine the audience: Consider who your stakeholders are and what information they are likely to be interested in. This may include shareholders, investors, lenders, or other parties with an interest in your company's financial health.

- Identify key points: Determine the key points that you want to communicate to your stakeholders based on the information in the balance sheet. This may include the company's financial position, risk profile, and potential for growth.

- Prepare a presentation or report: Use the key points and the information in the balance sheet to prepare a presentation or report that clearly communicates your company's financial position to stakeholders. Make sure to include relevant financial ratios and metrics that may be of interest to your audience.

- Communicate the information: Deliver the presentation or report to your stakeholders in a clear and concise manner, using visual aids and other tools to help convey the information effectively. Be prepared to answer questions and provide additional information as needed.

Conclusion

A balance sheet is a financial statement that presents a company's financial position at a specific point in time. It provides an overview of the company's assets, liabilities, and equity and is used to assess the company's financial health and stability. By understanding the balance sheet, preparing and interpreting it, and using it to make informed financial decisions, you can better manage your business and achieve your financial goals.

testimonials

What they say

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Mikayla Harris - Designer

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Anna Morgan - Blogger

How We Can Help

We're the most experienced catch-up and clean-up company in the United States. We've done over 900 successful clean-up projects since our founding in 2019.

Dedicated Bookkeepers

You'll be assigned a dedicated bookkeeper to work on your bookkeeping.

Simple Billing System

No surprise fees or hidden charges.

All U.S. Based Bookkeepers

All of our bookkeepers work and live in the United States (mostly in the Dallas, Tx area).

Fully Remote

With today's technology we work fully remote.